Reimagine how you measure business performance to adapt faster, work smarter, and perform better

This information is for you if…

- You want to glean more insights from business systems but are not a data scientist.

- You are looking to understand more about leading and outcome-based key performance indicators (KPIs).

- You need a framework to innovate through incremental improvements and continuous business process optimization.

Introduction

Ever-increasing disruption is putting more pressure on leaders within small and medium-sized businesses (SMBs). New competitors offering new business models or additional innovative products and services are entering the market faster than ever. Gone are the days when your only competition is a town over. In today’s digital world, consumers have access to products and services globally, continually changing their expectations on quality, availability, price, and how they want to do business with you.

Business success requires you to rethink how you operate fundamentally, not just today but tomorrow and every day after that. Organizations that thrive are those that can master change using a business continuity and resilience framework to drive business agility and continuous innovation.

All remarkable strategy frameworks start with how you can measure business outcomes. Traditional business key performance indicators (KPIs) focus on four critical dimensions:

-

Profit:

Tracking your bottom line or financial gains is critical for all businesses.

-

Profitability:

It is essential to know how efficient your company is at turning sales into profit or tracking margins and always working towards lean operations.

-

Growth rates:

Business continuity requires that you are forward-thinking and always looking for innovations that will accelerate growth, even during a crisis.

-

Risk and returns:

Thin margin businesses are riskier, as they cannot withstand an economic downturn for very long. And your investors will expect higher returns as the risk increases.

While the four dimensions above will always be critical to business success, these KPIs will not help you understand how quickly you can adapt to disruption. Nor will they provide a framework to help you measure continuous process, product or service innovation. This blog will introduce you to a different way of thinking about KPIs to help you measure business agility and business process optimization.

Key Performance Indicators (KPIs): What are they? And why do I need them?

The principle “what gets measured gets managed” dictates that by examining a process, you can not only better understand it, but you can also find ways to improve it or get back on track if you know in advance when you are off course. KPIs, help you measure strategic, financial, and operational performance compared to a set of targets, objectives, or industry benchmarks. However, many SMB leaders only focus on KPIs that measure business outcomes, which means they only know if they missed the target after it is too late to course correct. Business outcome or lagging KPIs are essential to understanding performance; however, you also need to track leading indicators to measure agility and continuous process optimization.

Using a framework that delivers a combination of outcome and leading KPIs will help you not only track financial performance but also:

• Focus and motivate employees to deliver results or solve critical problems

• Reinforce your business vision and customer promises

• Provide an early warning system to reduce risk

• Foster innovation and a growth mindset, data-driven culture

• Drive continuous process optimization to not only reduce

• costs and improve margins but also remove friction points to

• create optimal employee, customer, and vendor experiences

What to measure for agility and continuous business process optimization

Outcome (lagging) key performance indicators

demonstrate if you have achieved a set target, goal, or objective within a specific period. Examples include revenue, profit, profitability, customer satisfaction rates, website traffic, lead conversion rates, etc. Outcome indicators, by definition, are final when you get them. Lagging indicators are output-oriented.

Leading key performance indicators

are predictive measurements that show what an outcome will be in the future if the trend continues at the current rate. With leading indicators, you can make changes by adjusting processes or investments that get you back on track to hit your target or desired outcome. Leading indicators are result-oriented. A key question to ask is: “What processes, steps, or skills can I measure to achieve the target outcome?” For example, if your customer promise centers around easy returns, you would measure your return cycle time or how long it takes a customer to return a product. While customer satisfaction rate would be the outcome KPI, customer return time would be a leading KPI that ensures you successfully deliver on your brand promise.

1. Adapt Faster:

Measuring business agility and continuous process optimization

The Harvard Business Review announced that adaptability was the new competitive advantage back in 2011 and since then, buzzwords like business agility have flooded in. However, for SMBs, the ability to adjust and adapt, especially during times of volatility, is critical to survival. Agility must be more than just a concept; it needs to be embedded into your organization’s DNA. That is only possible if you use the right leading KPI’s to keep everyone precision focused on the speed of doing business and how long it takes you to implement business model changes.

Business model adaptability

Industries, customers, and markets change. Even where and how we work is changing rapidly. As are your business strategies, goals, objectives, services, and products. The ability to quickly diversify, scale, and change your business models is a competitive advantage in any market. As change is constant, so should be the metrics that you use to measure business adaptability be continually changing.

Some questions to ask to determine what you should measure:

- How easy is it for you to make changes to your current business model? How long does it take to set up a new company, customer, credit for a customer, vendor, employee, pricing structure, product, service, currency, etc.?

- How long does it take to change your website, SEO, or paid media advertising?

- How long does it take to hire a new employee? Change compensation or benefit plans? Change your organizational roles and hierarchy?

Understanding the above process speed times will help you measure how quickly you can change, but you will also want to focus on how open your people are to change.

-

- How empowered are your employees to recommend process changes or try new approaches in their roles? How often do you create employee objectives (OKRs)?

- How often do you conduct strategic planning?

- What is the Adaptability Quotient (AQ) of your employees? How quickly do they embrace inevitable challenges as changing dynamics arise, and your company needs to make strategic shifts?

- Are you able to reskill employees and rapidly onboard them into new roles instead of hiring new talent as your business changes?

Cash availability

In times of crisis, cash flow is king and critical to survival. It is often cited as the main reason that small businesses fail. Tracking your quick cash ratio will help you quickly see whether your cash, securities, and the money you expect to have soon (your accounts receivable) are enough to cover your liabilities. It will also show you if you need to pivot your current investments or if you have the money to implement the changes necessary to respond to disruption.

To calculate it, you add cash, marketable securities, and accounts receivable and divide by current liabilities. For example, if you have $25,000 in cash, $15,000 in accounts receivable and $10,000 in current liabilities, your calculation is

($25,000 + $15,000) ÷ $10,000 = 4

If your quick ratio is one or higher, you will have enough cash and liquid assets to cover outstanding bills. A quick ratio of less than one means that you need to adjust to cover your current liabilities

Brand affinity and sentiment

Understanding your customers’ opinions, attitudes, and emotional connections to your brand is called brand sentiment. This leading indicator can help inform how you’re doing in terms of your customer experience, product quality, price competitiveness, and loyalty. It can take some time to shift brand perceptions, so understanding how quickly and what engines help you improve these metrics ties into your adaptability. While changes to your pricing, quality, and buying process might take longer, you can utilize social media, rewards, and marketing to impact your brand sentiment and boost sales. There are tools available to measure brand sentiment from customer comments across social media platforms; however, you can also use analytics from your website. Ways to measure:

o Web traffic metrics, time spent on website or viewing content on social channels

o Direct surveys to your customer – using a tool like Microsoft Dynamics 365 Customer Voice

o Reviewing interactions on your social media channels

o Running promotions, social campaigns, or rewards programs

2. Work Smarter:

Productivity tracking

Understanding how long it takes for individuals to perform specific tasks and the effectiveness or accuracy of the work can help ensure employee success. It is also vital to understand if your business systems are impacting the productivity of your people. Keeping the pulse on your network infrastructure, application performance, and system uptime will ensure your people can do their best work— even when working remotely

-

Objectives and Key Results (OKRs)

While not by definition, a leading KPI, ensuring that everyone in your organization focuses on delivering objectives that tie to your business vision and customer promises is key to working smarter. OKRs also provide a clear employee performance framework that can also attract the right talent into your business.

Talented people want to work for companies to impact and grow their careers the fastest. By identifying the best possible result for each role, you create clarity around a picture of success. You also align each role to impact, which moves your business forward.

-

Productivity and Application Performance Scores

Many application vendors often promise to improve productivity; however, it has historically been challenging to measure. The Microsoft Productivity Score provides visibility into where you can improve people, technology, and workplace experiences.

While the Productivity Score measures Microsoft 365 apps’ effectiveness, most business applications also provide system performance insights. Keeping focused on continuous optimization of application performance will ensure your people are empowered to get more done in less time.

You can also measure how long it takes for individual employees or teams to complete specific tasks, such as sales and service calls, order entry, product assembly, inventory picks, etc. By helping employees track individual productivity, you can identify where additional training may be required or have top performers share best practices across the team. It can also help you identify better ways to configure dashboards and app layouts or where you may need to change processes or add in automation.

-

Project success and the cost performance index (CPI)

For project-intensive businesses, the way you manage work is critical to improving profitability. Of course, timeliness, budget, quality, and effectiveness are vital to measure. And you will also want to track number of returns, cancelled projects, billable utilization, and change requests. However, a leading indicator that will help you determine if you are likely to finish the project under or over expected costs is the Cost Performance Index (CPI):

CPI = Earned value / Actual costs

3. Perform Better:

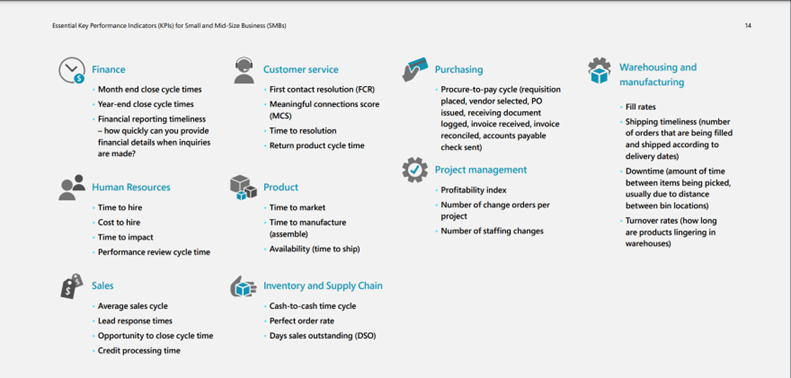

Indicators to track cycle times of key business processes

While this blog outlined vital business performance metrics in the introduction, this section focuses on process time or cycle times that can be measured to get leading indicators that tie to outcome KPIs.

The questions to ask here are: how do we improve operational performance to deliver better outcomes to customers, vendors, and employees? And how do we optimize processes to reduce costs and increase financial performance?

What indicators will help us predict if we are on track to meet revenue, gross margin, or growth objectives?

Tip:

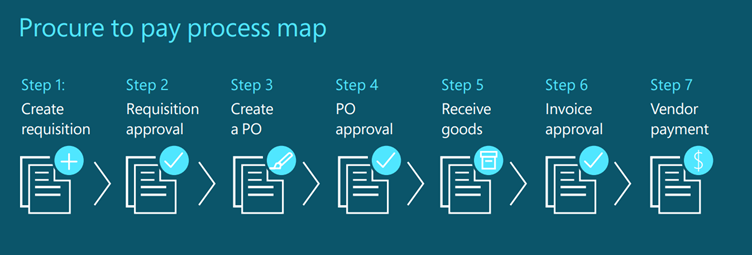

Take the time to build operational excellence maps, which fuel continuous business process optimization. These maps provide visual representations of your operational processes, for example, your hiring, procurement, customer acquisition or financial reporting workflows.

By mapping your current operations, you will get a better understanding of how your business runs to identify bottlenecks, inefficiencies, and opportunities to better serve your customers.

The KPIs that you select to measure the processes in those maps will be your leading indicators. We provide you with best practices by department here.

Tracking profit, profitability, growth rates, and risk and returns remain the backbone of KPI tracking is indeed a necessity. Going a level deeper and adding the KPI’s that can help your business pivot quicker is the key for SMB’s to stay agile and profitable in today’s marketplace.

This blog introduced you to KPIs that can help you measure business agility and business process optimization, giving you the tools, you need to continually measure your process, product, and service innovation long before they hit your bottom line KPI’s.

Measuring the right KPI’s can ensure your business embraces agility as more than just a concept by embedded the ability to adapt into your organization’s fabric. Using the right leading KPI’s will keep everyone precision focused on the speed of doing business and delivering optimal outcomes to your customers. This is only possible if you have the rights tool to track data across your entire business and measure the right leading and outcome KPI’s.

Why Dynamics 365 Business Central?

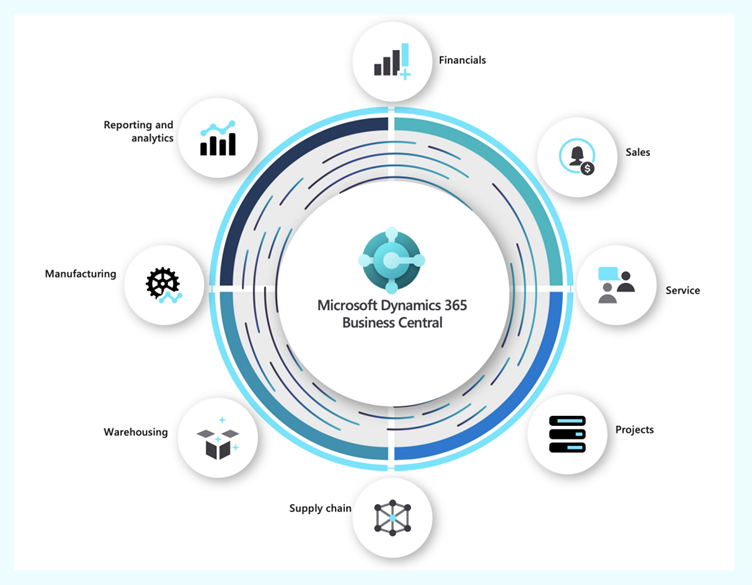

To make your business dreams a reality, you need business solutions that keep pace with a continually changing world. That’s why successful SMB’s have moved to the cloud with Microsoft Dynamics 365 Business Central.

Now more than ever, SMBs need to embrace digitalization because “business as we know it” has changed. Expectations have changed. The customer experience has changed. Even where we work and how we work is changing right before our eyes. Yet, so many businesses remain limited by systems that don’t allow for change. That’s why we launched our next evolution of Microsoft Dynamics 365 NAV, GP, and SL.

To help SMBs become powered by the cloud, powered by connected data, and powered by business intelligence.

We brought together the productivity of Microsoft Office 365, the data connectivity and business intelligence of the Microsoft Power Platform, and the security, scale, and geographic presence of Microsoft Azure. Dynamics 365 Business Central unifies those assets into a single application that connects business management across finance, sales, service, supply chain, distribution, and manufacturing.

Get access to the performance metrics that help you to adapt faster, work smarter, and perform better.

When you’re ready to step into business agility, we’re here to help.

Source: Microsoft.com

Let’s Build Digital Excellence Together