The insurance industry is highly competitive and constantly adapting to challenges such as changing customer needs and competition from new, non-traditional entrants. One of the key drivers of this transformation is the adoption of digital tools like Customer Relationship Management (CRM) systems. CRM for insurance industry have significantly changed how insurers manage customer interactions. They help improve customer satisfaction and loyalty, make sales and marketing processes more efficient, and provide deeper insights through customer data analysis.

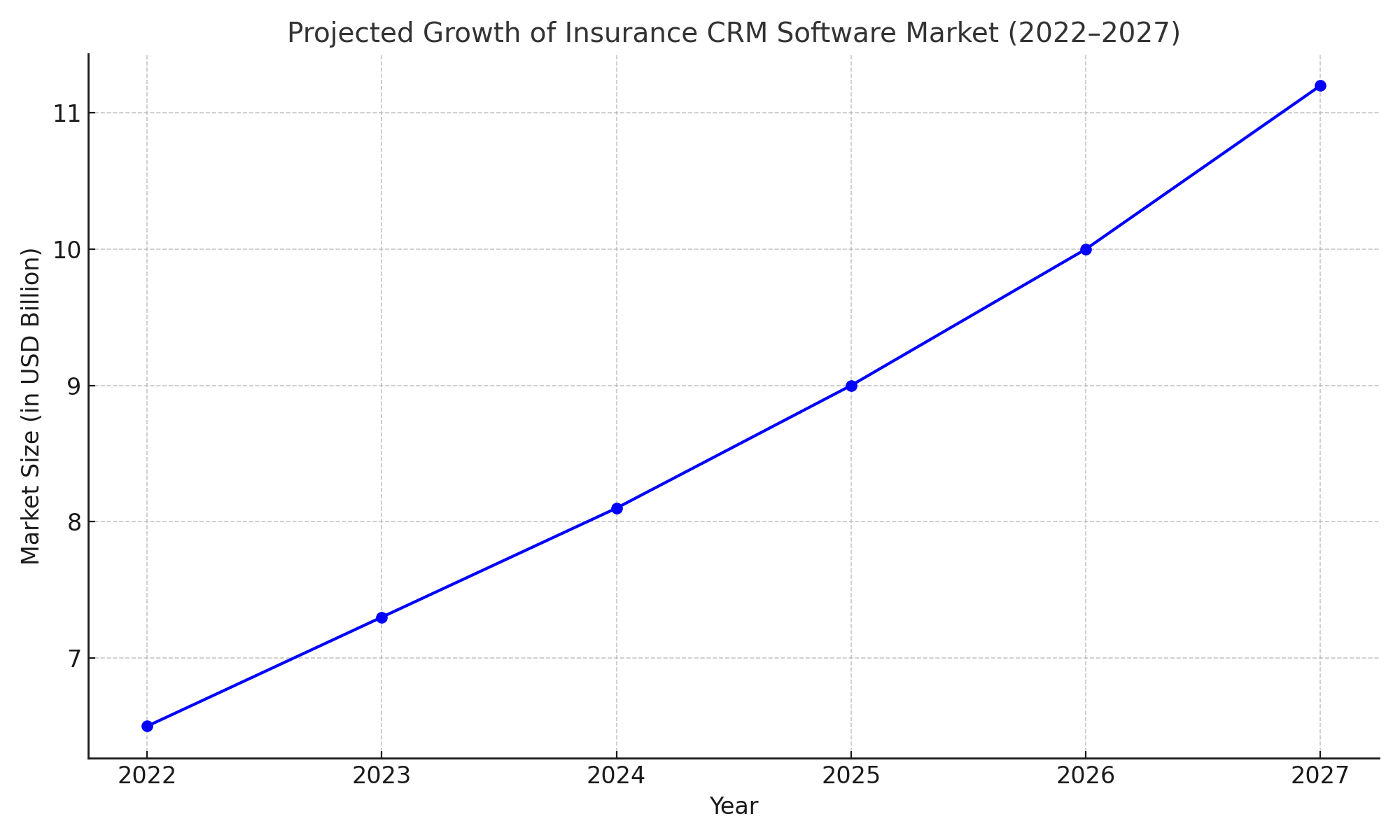

According to the report, the global Insurance CRM Software market is projected to grow from USD 6.5 billion in 2022 to USD 11.2 billion by 2027, at a CAGR of 11.2%.

In this blog, we will explore the 10 powerful benefits of CRM for insurance industry, highlighting how it enhances customer relationships, increases team productivity, and supports growth in a competitive market.

What is CRM Software?

CRM software is a solution that helps businesses efficiently manage and strengthen their relationships with customers. It comes equipped with essential features such as contact management, sales and marketing automation, task tracking, and analytics. These capabilities help improve business operations and overall performance.

An intuitive sales CRM platform also captures key customer details such as purchase history, length of the relationship, and previous interactions. This provides a complete, 360-degree view of each client, allowing businesses to offer more personalized and meaningful experiences. This level of service is crucial for building long-term customer loyalty.

Overall, CRM software combines several powerful tools to help businesses better understand and manage their customer relationships.

With so many CRM options available, it’s important to select one that fits your business needs. If you’re unsure where to start, our team of experts can help you find the most suitable CRM solution for your insurance agency.

10 Benefits of CRM Software

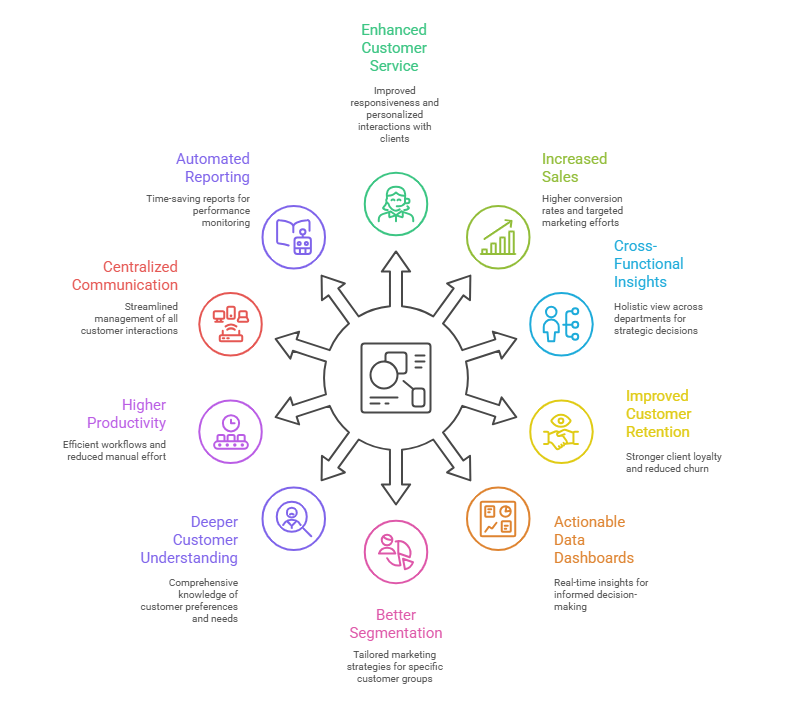

Using CRM software can bring numerous advantages to your insurance agency. Below are the top 10 benefits of using the best CRM for insurance agents to grow your insurance business.

Enhanced Customer Service

Strong client relationships are essential for business success, and a CRM system makes it easier to manage those connections effectively. With all customer information stored in one centralized location, you can respond to inquiries, resolve issues, and address concerns more quickly and efficiently.

Additionally, the insights gained from CRM data can help you pinpoint areas where your customer service may need improvement, allowing you to make adjustments that lead to a better overall experience for your clients.

Increased Sales

Having a clear and comprehensive view of your customer relationships allows you to identify upselling and cross-selling opportunities more effectively. A CRM system helps you target marketing efforts with greater precision, leading to higher-quality leads and improved conversion rates. It also supports accurate sales forecasting, helping you stay on track with your sales goals.

Moreover, CRM tools enable you to monitor the progress of your sales pipeline, making it easier to spot where deals are stalling and take corrective action to improve your overall sales performance.

Cross-Functional Insights and Reporting

A robust CRM system offers valuable insights across various departments, including sales, marketing, customer service, finance, and accounting. This holistic view helps you understand how different areas of your business are interconnected, enabling you to make smarter, more strategic decisions.

By adopting a data-driven approach, you can boost overall performance and stay focused on achieving long-term business goals. The analytics and reporting features of a CRM also allow you to generate custom reports, monitor key performance indicators (KPIs), and make informed decisions that contribute to stronger business outcomes.

Improved Customer Retention

CRM software plays a key role in maintaining strong customer relationships, helping ensure clients remain loyal over time. By having a clear understanding of each customer’s journey, you can spot potential issues early and address them before they escalate.

Monitoring customer satisfaction through your CRM can lead to higher lifetime value and reduced churn. With this insight, you can take proactive steps to enhance the customer experience and build lasting loyalty.

Actionable Data Dashboards

An effective CRM system offers interactive dashboards that deliver real-time insights into your business operations. These dashboards enable you to make fast, informed decisions based on current data, helping you stay in control at all times.

With all key metrics accessible in one centralized view, actionable dashboards allow you to monitor performance across departments and respond quickly to changing business needs.

Better Segmentation

A CRM system enables you to categorize your customers into specific segments, allowing you to tailor your marketing and sales strategies to meet the unique needs of each group. This targeted approach helps deliver more personalized and relevant messaging.

Segmentation also allows you to generate detailed reports that reveal the buying patterns and preferences of each group. These insights can enhance your overall marketing strategy and guide smarter decisions on how to allocate your resources effectively.

Deeper Understanding of Customers

A CRM system provides a comprehensive view of each customer, helping you better understand their preferences, needs, and challenges. This valuable information can be used to refine your products or services to better align with what your target audience is looking for. Additionally, CRM tools allow you to build detailed customer profiles, which support more precise segmentation and enable you to tailor your marketing efforts for greater impact.

Higher Productivity and Efficiency

Having all customer information centralized in a CRM system allows your team to work more efficiently and accomplish more in less time. With instant access to essential data, you can eliminate time spent searching through scattered records and focus on high-value tasks that drive business growth.

Moreover, automating routine and repetitive activities through the CRM reduces manual effort, freeing up your time to concentrate on strategic priorities and core business functions.

Centralized Communication Management

A CRM system allows you to manage all customer communications in one place, including emails, phone calls, social media messages, and even physical mail. Having everything organized in a single platform makes it easier to respond quickly to inquiries and resolve issues, leading to improved customer service and satisfaction.

In addition, CRM software can automate communication tasks, helping you stay connected with your customers without spending hours on phone calls or writing individual emails.

Automated Reporting

With a CRM system, you can automatically generate reports to monitor performance and highlight areas that need improvement. This not only saves time and effort but also frees you up to concentrate on other critical business activities.

Moreover, automated reporting helps uncover valuable trends, enabling you to fine-tune your strategy. This proactive approach keeps you ahead of competitors and supports steady business growth.

Final Thoughts

Insurance CRM Softwares are transforming the insurance industry through automation that simplifies even the most complex processes. Insurance companies have seen significant advantages as CRM solutions help them focus on what truly matters, such as building strong customer relationships and delivering personalized, data-driven product offerings. This approach improves client acquisition and retention while increasing customer lifetime value (CLV).

As competition intensifies in the insurance sector, using the best CRM for insurance agents allows companies to stand out and offer enhanced service. This wave of innovation is reshaping the entire insurance landscape and is set to change the way the industry functions in the years ahead. Have questions about choosing the right CRM for your insurance business? Get in touch. We’d be glad to have a conversation.

FAQs

Microsoft Dynamics 365 Sales is one of the best CRMs for insurance agents, offering tools to manage leads, automate sales processes, and build stronger client relationships through personalized, data-driven engagement.

A CRM for insurance companies centralizes customer data, automates follow-ups, and personalizes interactions, making it easier to nurture long-term relationships and increase client loyalty.

Yes, Dynamics 365 Sales CRM automates reminders and follow-ups, making it easier for insurance agents to manage and secure timely policy renewals.

Yes, a CRM for insurance industry like Dynamics 365 enables agents to track, score, and manage leads throughout the entire sales pipeline.

Wondering which CRM is best for your insurance company?