Tired of tracking invoices by hand? There’s a better way. AI Invoice automation software is revolutionizing financial workflows for modern enterprises.

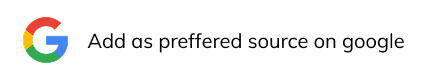

A Softco report (2025) highlights that AI-powered invoice automation cuts costs by over 70%, dropping per-invoice expenses from $6.20 to $1.83.

With AI-driven precision, Microsoft Dynamics 365 Business Central helps simplify billing, cut down on errors, and improve efficiency.

This guide outlines a step-by-step approach for implementing intelligent invoice workflows tailored to your business needs and growth goals.

What is AI-Powered Invoice Automation?

With AI invoice automation, businesses can eliminate manual invoice tasks and focus on improving speed, precision, and efficiency. It leverages Machine Learning and OCR to extract, validate, and process invoice data without manual input. Automatization helps optimize approvals, reduces errors, and accelerates workflows, thereby helping businesses process invoices faster with greater accuracy.

Why Invoice Automation Matters for SMEs

According to Forrester, AI is revolutionizing invoice matching and data capture, replacing outdated OCR tech. For SMEs, manual handling of invoice processing can be time-consuming. It can also exhaust valuable resources, thereby triggering costly errors, payment delays, and potential compliance violations. That is exactly when AI-powered automation comes into play. Harnessing AI capabilities streamlines the process by extracting invoice data, matching purchase orders, and posting entries in real time. As a result, efficiency goes up, with no more chasing approvals or double-checking entries. Business Central’s invoice automation gives SMBs a smart edge, turning invoicing into a strategic, automated process.

A Step-by-Step Journey to AI-Powered Invoicing in Business Central

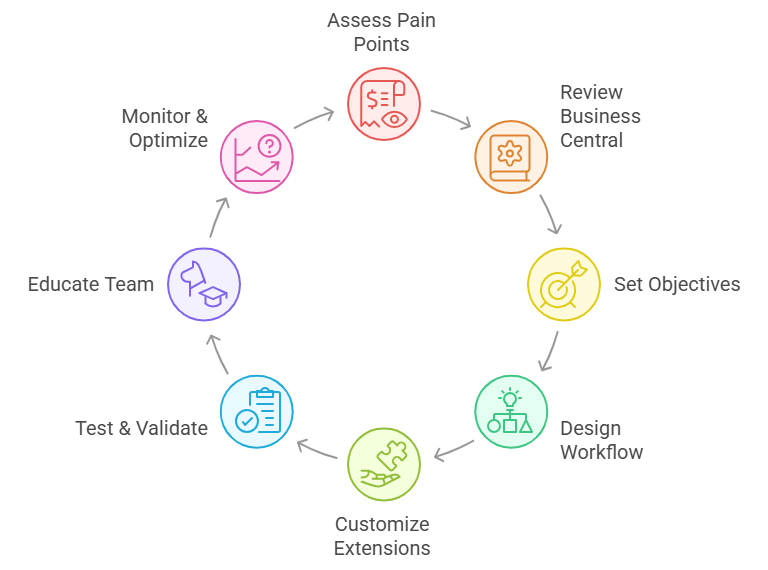

Step 1 Assess Your Invoicing Pain Points

Begin by identifying the challenges in your existing invoicing process. Check delays, manual errors, or costs involved, as these factors can contribute to slowing down processes. By pinpointing these issues, one can determine where AI can deliver the most value. Additionally, it is necessary to look at approval times, data entry tasks, and audit trails.

These initial assessments set the groundwork needed to begin automation by highlighting inefficiencies and preparing your team for a smoother transition to AI-powered invoicing in Business Central.

Step 2 Start by Reviewing What Business Central Offers Out of the Box

Prior to implementing AI-powered enhancements, start by reviewing what Business Central offers out of the box. The platform’s core capabilities support automated billing, recurring invoices, payment tracking, and integration with financial ledgers.

Understanding these built-in capabilities helps identify what’s already efficient and where customization or AI can add value. This foundational step ensures smarter decisions, reduces redundancy, and sets the stage for a streamlined, intelligent invoicing workflow. Thus, aligning your automation strategy with Business Central’s strengths helps save time, boosting the ROI from the start.

Step 3 Set Clear Automation Objectives

Lack of clear objectives can lead to execution pitfalls that derail automation programs. So, it is essential to clearly outline what you want to achieve with invoice management automation in Business Central. Determine key outcomes, such as speed, fewer errors, or faster approvals.

If you prioritize reducing processing time, cutting manual errors, or improving cash flow visibility, then defining quantifiable objectives will serve as a guide for your implementation and tracking success. Moreover, by bringing key stakeholders into the loop, you can align your automation objectives with broader business priorities.

Specific targets help ensure your invoice automation solution works toward what really counts, that is, cutting costs and scaling effectively. These goals foster ongoing invoice optimization and drive long-term value.

Step 4 Design Intelligent Workflow Architecture

For optimizing invoice automation software, start by designing an intelligent workflow architecture aligned with your business needs. From data capture and validation to approval and posting – mapping out every step ensures alignment with your current processes.

Leveraging AI tools enables real-time invoice matching, fraud detection, and exception handling. A well-designed architecture not only reduces delays and errors but also ensures seamless communication between Business Central and external systems. Such a robust foundation allows for scalable, flexible, and intelligent invoice management automation.

Step 5 Customize Extensions for Advanced Logic

Supercharge your invoice workflow by personalizing Business Central with smart extensions. By utilizing AL language, build advanced logic that handles exceptions, validations, and multi-layered approvals. For connecting with external tax engines or vendor systems, you need to integrate APIs seamlessly.

With tailored extensions, you are in control, and your automation can reflect your company’s individual practices. This gives us an accurate estimate with less manual intervention and makes the method scalable. And when implemented correctly, it allows you to stay in compliance with rules-based invoice processing and make more informed decisions.

Step 6 Test & Validate Automation Flows

Validate your AI-powered automation setup before going live, using real invoices and business scenarios. To check how the system responds, run simulations for use cases like repeated payments, mismatched vendors, and tax inconsistencies.

This makes it easier to identify holes, tweak logic, and make processing flow smoothly. Verify the results with your finance organization to increase confidence in the output. Real-world tests not only prevent post-deployment problems but also protect your automation against real business conditions. It’s crucial for long-term success.

Step 7 Educate Your Team & Ensure Adoption

Team understanding and buy-in are key to successful AI-powered automation. Educate your finance and operations team on how the system functions, including new processes and exception handling. Then offer hands-on training sessions, user manuals, and ongoing support to build confidence.

Encourage feedback and engage users from the beginning to ease the transition. When teams realize the value and believe that they are supported, it makes a tremendous difference in adoption. Training users ensures smoother operations, fewer errors, and greater payoff on your AI investment. Empowerment drives successful implementation.

Step 8 Monitor, Measure & Optimize

After deployment, you must continuously track the performance of your AI-powered invoice automation. Leverage dashboards and reports in Business Central to monitor key metrics like processing time, error rates, exceptions, etc. Review these insights regularly to look for trends, gaps, and areas for improvement.

Furthermore, continually optimize workflows according to real-time data and team feedback to ensure ongoing efficiency. This process is not a once-and-for-all step, but a cyclical one. Watching and refining your system helps maintain accuracy, boost productivity, and remain responsive to evolving business needs.

Key Features of AI Invoice Automation in Business Central

Here are the standout features of AI invoice automation in Dynamics 365 that prove to be a game-changer for efficient and error-free invoice processing:

- Email-Based Invoicing: Automates invoice processing by using AI to extract invoice data from vendor emails, cutting down manual work, minimizing errors, and speeding up approval workflows for smoother and efficient financial operations.

- AI-powered Data Extraction: Intelligently identifies and captures relevant information from documents such as invoices or receipts. This helps reduce manual data entry, thereby enhancing accuracy and enabling faster processing across financial and operational workflows.

- Predictive Payment Insights: AI is highly beneficial in analyzing payment patterns and customer behavior. This enables businesses to forecast cash flow, identify potential delays, and make informed decisions to optimize financial planning and receivables management.

- Customizable GL Account Mapping: Lets businesses tailor how transactions are linked to general ledger accounts, ensuring accurate financial reporting, simplifying compliance, and adapting to unique operational or industry-specific accounting needs.

- Flexible Approval Workflows: Enables businesses to set custom rules for invoice routing based on criteria such as amount or vendor, allowing for multi-level approvals, reducing bottlenecks, and ensuring faster, more controlled financial processing.

- Direct PDF Access & Search: Users can open, view, and look for PDF documents within the platform. This simplifies document handling, improves data retrieval, and enhances productivity without needing to toggle between applications.

- Real-Time Monitoring & Dashboards: Offers instant visibility into key metrics through customizable visual displays, enabling speedy decision-making, proactive issue resolution, and improved operational control across finance, inventory, and sales processes.

Maximizing ROI with AI-Powered Invoice Automation in Business Central

Seeking a hassle-free ROI boost? An invoice automation solution in Business Central ERP will help you achieve that. This integration helps prevent the waste of time, money, and effort, which ultimately maximizes ROI. Now, you are not required to enter data manually or chase approvals; the system will manage it all for you. It does so by extracting invoice details, routing them for sign-off, and matching them to the right accounts. This leads to fewer errors, faster payments, and clearer cash flow.

“AI is the defining technology of our time. It’s transforming every industry, including finance, by amplifying human ingenuity.” – Satya Nadella, CEO of Microsoft

Rather than unnecessarily spending on manual tasks like paperwork, teams can now prioritize strategic work. Plus, finance leaders can make better decisions with real-time insights – all thanks to the invoice automation feature. Besides, lower processing costs and tight compliance allow businesses to eliminate expensive errors. It’s a more efficient, more rewarding approach to invoice management.

Implementing AI Invoice Automation in Business Central with Intelegain

Invoice automation is more than just convenience; it’s a strategic move. As per a report, automation helps curb late payments by 30% and improves cash flow visibility by 28%. With Intelegain’s tailored approach, your business can cut costs, reduce delays, and scale intelligently. Ready to optimize your invoicing with AI? Connect with us to automate invoices and unlock smarter workflows in Dynamics 365 Business Central.

FAQs

AI invoice automation software in Business Central is the Power Platform, to extract, validate, and automate approvals of invoices leverages AI Builder and Power Platform to extract invoice data, validate it, and automate approvals - streamlining vendor invoicing directly within your ERP system.

Yes, it is possible to automate invoice processing with the help of invoice automation software. It does so through extracting, validating, and routing invoices to speed up approvals and reduce manual tasks.

With Business Central’s AI invoice automation, handling invoices becomes easy. It reads PDFs, posts entries, and sends them for approval, all using shared inboxes and vendor profiles to keep everything flowing smoothly.

Machine learning, optical character recognition (OCR), and natural language processing (NLP) are commonly used AI technologies for invoice processing in accounting.

Yes, out-of-the-box features enable automation using shared email folders, AI Builder, and approval workflows.